[Financial Express | Kuala Lumpur]

As we step into 2025, a sweeping reform in Malaysia’s EPF withdrawal policy is shaking up the financial landscape, prompting millions of employees to reassess their retirement savings strategy. The Employees Provident Fund (KWSP) has officially rolled out the EPF 2025 policy, transforming the traditional KWSP withdrawal process and revolutionizing how Malaysians approach retirement planning.

Surprisingly, many have yet to grasp the profound implications of these changes. This isn’t just about what you can withdraw now — it’s about shaping the quality of life for the next 30 years. Our financial correspondent digs deep to decode this pivotal policy shift and what it truly means for your future.

A New Chapter Unfolds: Flexibility vs Responsibility in EPF Withdrawals

Over the years, Malaysians’ perception of the EPF has evolved dramatically. What was once a rigid “forced savings” model is now shifting toward “smart withdrawals with long-term consequences.” The newly introduced EPF 2025 policy exemplifies this transition.

Key highlights of the policy include:

- Account 3 Activation: Up to 10% of monthly contributions now go into a new Account 3, which allows anytime withdrawals;

- Withdrawal Risk Alert System: A digital notification warns members about the long-term impact of each withdrawal;

- Capped Withdrawals & Frequency Controls: Designed to prevent excessive withdrawals and secure long-term financial stability.

While this enhanced freedom is welcomed, it also places more responsibility on individuals to manage their own financial future. Freedom to withdraw does not mean freedom from consequences.

At a Glance: The New KWSP Withdrawal Process (2025 Version)

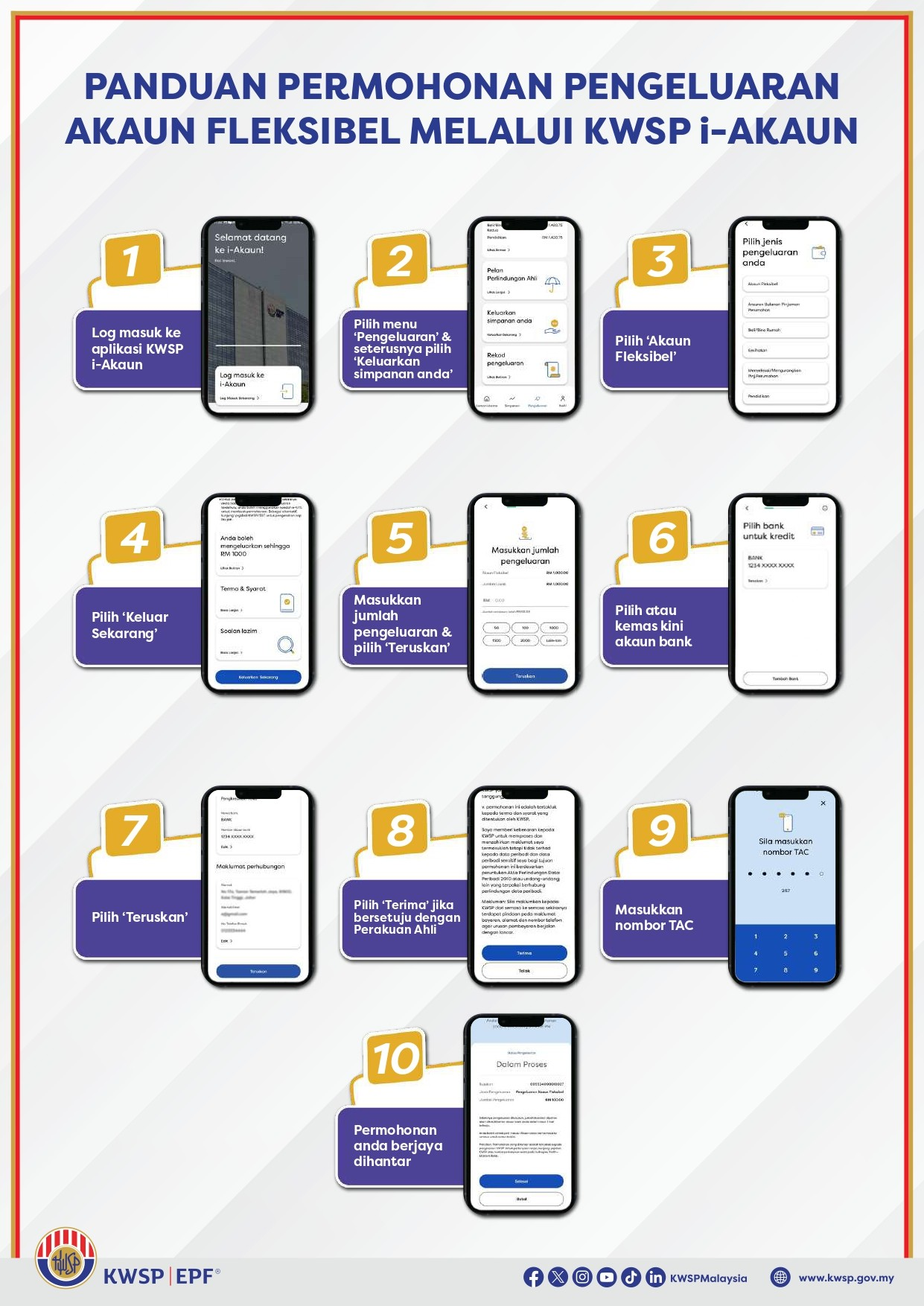

In line with modern expectations, both the KWSP website and the MyEPF app have been upgraded to reflect the new process. Here’s a streamlined overview of the KWSP withdrawal process:

- Log in to the KWSP online platform;

- Select your withdrawal category (housing, education, medical, emergency, etc.);

- System auto-checks your eligibility and withdrawal limit;

- Upload required documents (e.g., NRIC, support letters);

- System evaluates risk and matches you with relevant policies;

- Approval within 3–7 business days, funds credited thereafter.

It’s worth noting that each withdrawal leaves a digital footprint, which may affect future loan eligibility or benefit claims. Frequent withdrawals might hurt your financial credibility.

Expert Warning: EPF Withdrawal Are a Choice — Not a Cheat Code

Though the system has been relaxed, financial advisors strongly urge the public to approach withdrawals through the lens of retirement planning, not short-term relief.

Renowned financial planner Michelle Wong explained, “Yes, withdrawals solve today’s problems. But what about the day after tomorrow? If we don’t plan, our future selves will be the ones paying the price.”

She proposed the “3R” withdrawal principle:

- Review: Examine your current financial needs;

- Rethink: Is this withdrawal necessary? Is there an alternative?

- Replan: After withdrawing, how will you replenish the lost savings?

Michelle emphasized that those who repeatedly withdraw early in their careers often reach retirement with dangerously low balances — compromising quality of life and increasing dependency on public support.

Deep Dive into the EPF Withdrawal 2025 Policy: More Options, Greater Accountability

Unlike previous emergency withdrawal schemes, the EPF 2025 policy represents a shift in mindset — from reactive policies to proactive financial literacy. We’ve identified three key features of the reform:

1. Flexible Account 3: From Saving-Only to Emergency-Ready

Now, a portion of your EPF contributions are instantly accessible. Great in times of need — dangerous if abused.

2. Withdrawal Risk Alerts: Know the Impact Before You Click

AI-powered alerts simulate your retirement outlook post-withdrawal, giving you a reality check on future balance risks.

3. Personalized Retirement Forecast Tools

By inputting lifestyle habits, health conditions, and desired retirement age, members receive projected income scenarios and financial guidance.

These tools are designed not just for convenience but also for cultivating long-term financial discipline.

Retirement Planning Reimagined: From “Enough Money” to “Living Well”

Many still hold on to outdated beliefs — that having a house and children ensures a stable retirement. However, KWSP data reveals that over 60% of members aged 55+ have less than RM50,000 in their accounts.

You might live to 80, but what if your EPF only sustains you until 60? That’s a 20-year gap you must financially bridge. Therefore, retirement planning is no longer optional; it’s essential — not just for the wealthy but for every wage earner.

Bottom Line: Every Withdrawal Shapes Your Retirement Story

The EPF withdrawal policy overhaul doesn’t just open the door to flexibility — it hands you the steering wheel. But with that control comes the need for wisdom and foresight.

In 2025, you can no longer withdraw on impulse. You must think like an investor — evaluating returns, measuring risks, and forecasting outcomes.

Because the decision you make today isn’t just about now — it’s about how you’ll live for the next 30 years.

Outbound Link:

【Revealed】KWSP Withdrawal Process Transformed in 2025—Missing Out Could Cost You